do you pay taxes when you sell a car in texas

Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets.

Should You Be Charging Sales Tax On Your Online Store Sales Tax Tax Filing Taxes

Do you pay sales tax when buying a car in Texas.

. The sales tax for cars in Texas is 625 of the final sales price. This way you dont have to pay a sales tax on your car in the new state when you re-register it. In most states the cars recipient must fill out the bulk of the paperwork and this includes tax paperwork.

Classic cars have a rolling tax exemption. Do you have to report sale of car on tax return. Whether you actually complete.

While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. If you sell a used car for less than its original purchase price plus any long-term improvements the buyer may have to pay sales tax on the purchase but you wont incur a tax obligation. If the buyer is living in another state then the tax would need to be paid in.

If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the. Before you set your budget for your new vehicle be sure to calculate the taxes and fees you must pay. Even if you purchased your new car in a different state you will pay sales tax for the state where you register the vehicle.

There are some other loopholes too. This means that you save the sales taxes you would. Who pays sales tax when selling a car privately in Texas.

If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever. If you sell it for less than the original. Income Tax Liability When Selling Your Used Car.

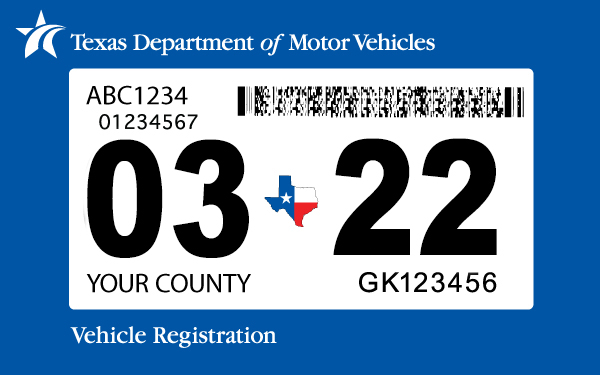

Understanding Texas Taxation on Vehicles Normally those registering a new or used car in Texas will need to pay sales and use tax based on the net sale price of the car. The Texas Comptroller states that payment of motor vehicle sales taxes has to be sent to the local. Depending on your location you may pay no taxes receive a tax credit on.

Instead the buyer is. If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer. When you sell a car for more than it is worth you do have to pay taxes.

However you do not pay that tax to the car dealer or individual selling the. The tax is computed on the remaining selling price for the purchased. Motor vehicle sales tax is the purchasers responsibility.

If the seller is not a Texas licensed dealer the purchaser is. The answer to this question is no you do not have to pay taxes on the sale of your vehicle unless of course you actually sell your car for more than what its worth or more than. Selling a car for more than you have invested in it is considered a capital gain.

To be eligible the trade-in must be taken as part of the same sales transaction and transferred directly to the seller. Paying Taxes On Gifted Vehicles. Thus you have to pay.

In Texas the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax.

Nj Car Sales Tax Everything You Need To Know

The States With The Lowest Car Tax The Motley Fool

How To Gift A Car In Texas 500 Below Cars

States With The Highest And Lowest Property Taxes Property Tax States High Low

Which U S States Charge Property Taxes For Cars Mansion Global

Pin By The Von Illyes Group On Crowley Texas Real Estate Crowley Texas Real Estate Finding A House

Motor Vehicle Information Fort Bend County

What To Do With Your Tax Refund Tax Refund Investing Finance

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Finance Investing Infographic Math Review

Understanding Your Tax Forms 2016 1099 K Payment Card And Third Party Network Transactions W2 Forms Tax Forms Ways To Get Money

Texas Car Sales Tax Everything You Need To Know

Hennessey Will Sell At Least 30 290 Mph Venom F5s For 1 3 Million Each Hennessey Venom Gt Hennessey Super Cars

Certsimple Usa Llc Land Surveying Certs Tax

Los Angeles Maven To Get More Than 100 Chevy Bolt Evs Cheap Cars For Sale Electric Cars For Sale Cars For Sale

Pin By Auto Lifestyle On Salvage Cars Faqs Salvage Cars Car Dealer Vehicles