what is suta taxable wages

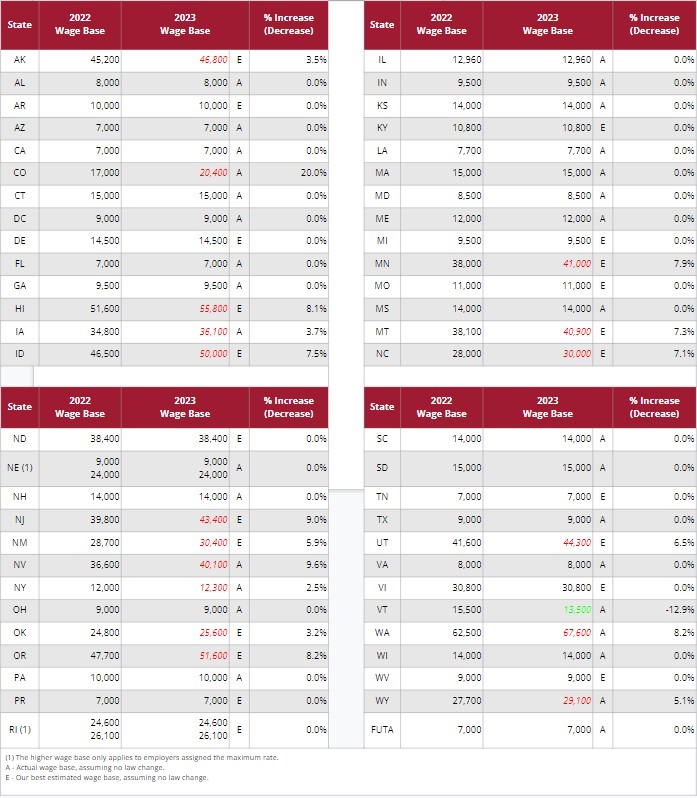

The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers. The states SUTA wage base is 7000 per employee.

Texas Suta Increases Will Impact Employers What You Need To Know Nextep

The Medicare percentage applies to all earned wages while the Social Security.

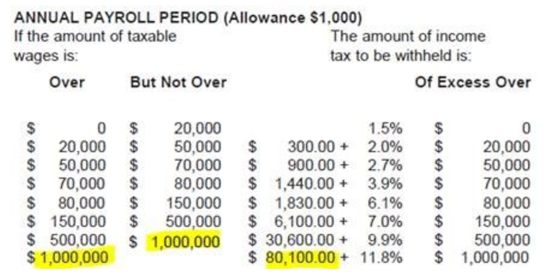

. Employers that are liable for Missouri unemployment tax contributions must provide the Division of Employment Security DES information on the wages of their covered employees each. For example in 2022 employers in the best positive-rate class were assigned a tax rate of 0207 percent and would pay only 9625 for each employee who makes at least the 2022 wage base. An employers tax rate determines how much the employer pays in state Unemployment Insurance taxes.

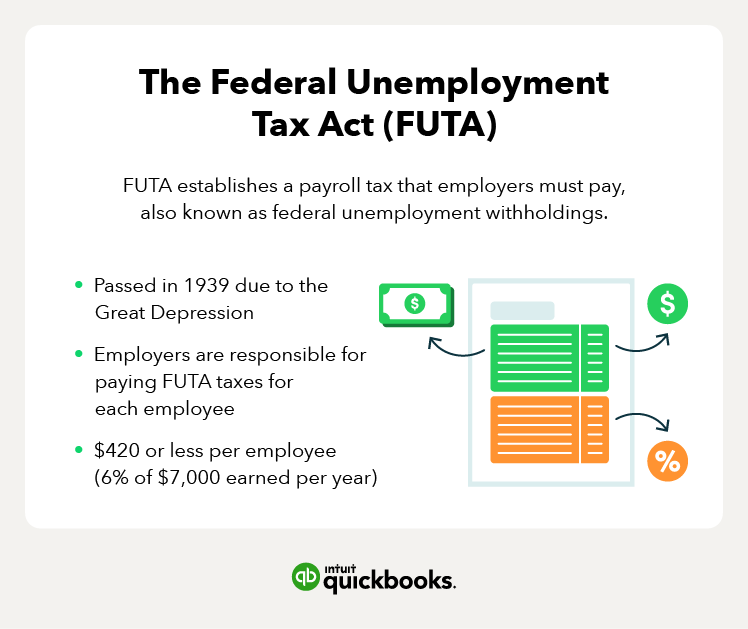

FUTA taxes named for the Federal Unemployment Tax Act are payments of a percentage of employees wages that employers must pay. Special Assessment Federal Loan Interest Assessment for 2022 from 180 to 000. Taxable base tax rate.

What is SUTA tax. Wages are compensation for an employees personal services whether paid by check or cash or the reasonable cash value of noncash payments such as meals and lodging. You have employees with the.

For 2022 this limit. If the employer paid. Typically it is only paid by.

24 new employer rate Special payroll tax offset. To calculate the amount of unemployment insurance tax payable TWC. You will be liable for state unemployment taxes if the total amount of wages you pay for domestic services in a calendar quarter equals or exceeds 1000.

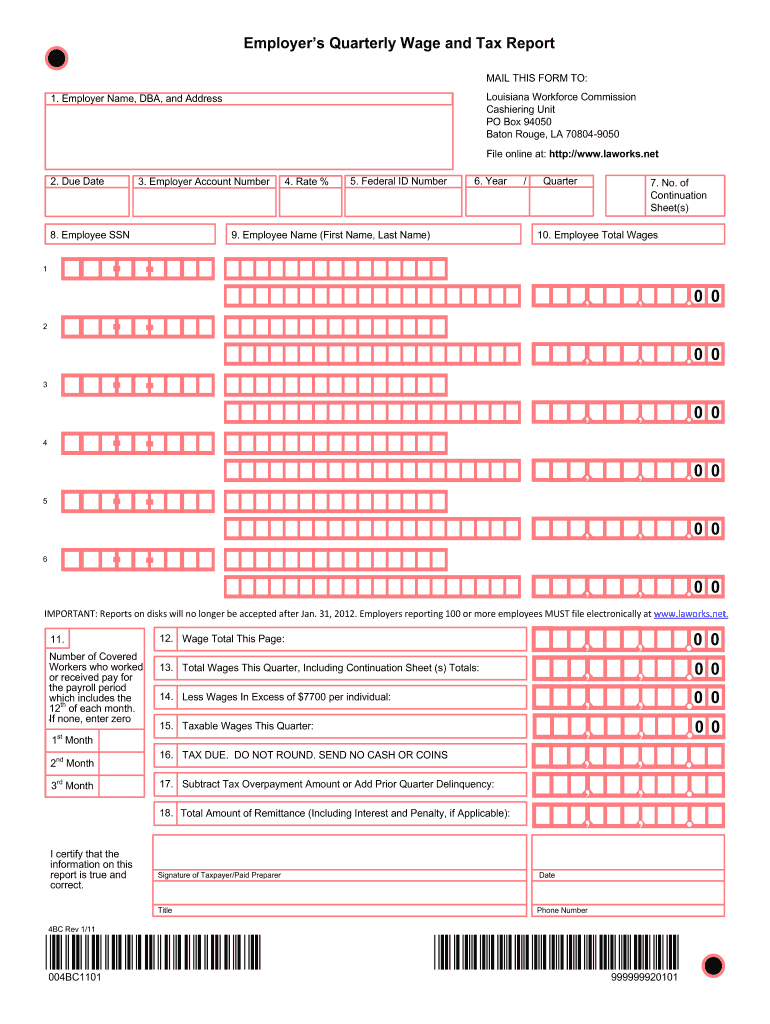

The report and tax will be due on a. Current Tax Rate Filing Due Dates. The current taxable wage base that Arkansas employers are required by law to.

Additional Assessment for 2022 from 1400 to 000. To calculate the amount of tax to be paid by an employer multiply the amount of taxable wages paid during the quarter by the employers effective tax rate. The unemployment insurance tax is computed on the wages paid to each employee on a calendar quarter basis.

In some cases however the employee. Benefit wage charges BWC are the taxable base period wages reported by an employer to OESC through the quarterly wage reports which are not to exceed the annual limit. Employees must pay 765 of their wages as FICA tax to fund Medicare 145 and Social Security 62.

The State Unemployment Tax Act otherwise known as SUTA requires employers to pay a payroll tax directly into each states unemployment fund. Base Tax Rate for 2022 from 050 to 010. Since your business has no history of laying off employees your SUTA tax rate is 3.

During 2019 Jordan Company Was Subject To The Alaska State Course Hero

Suta Wage List General Instructions

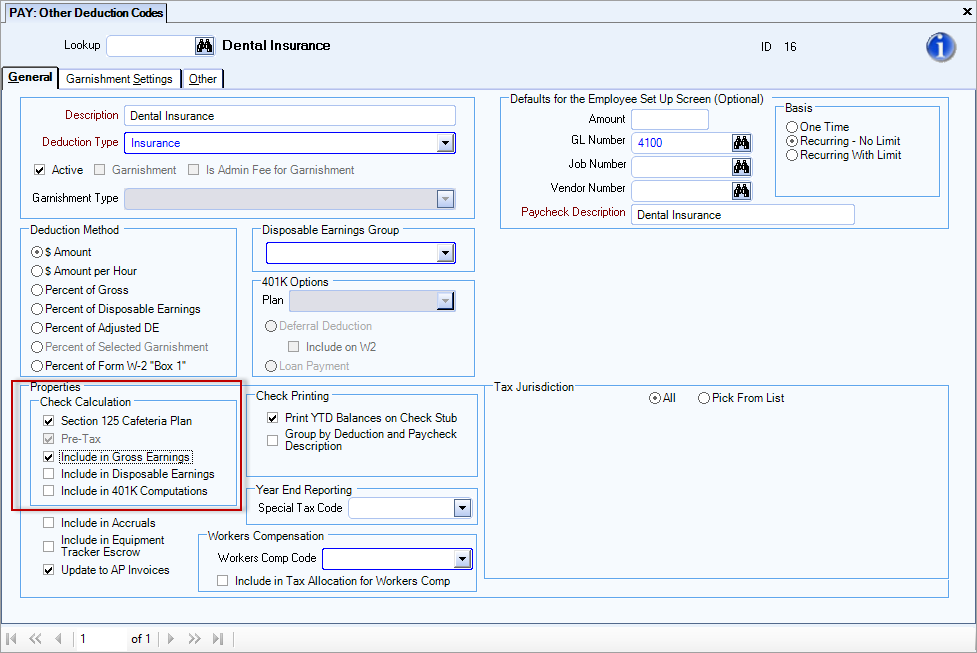

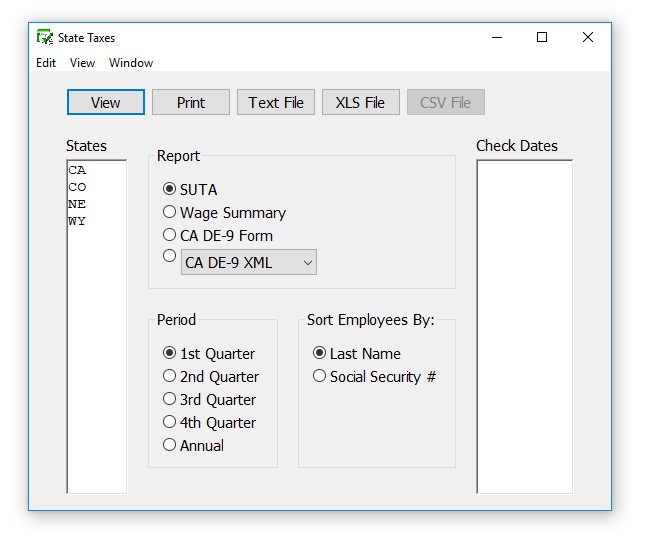

How To Create Suta Taxes Reports In Checkmark Payroll Checkmark Knowledge Base

View All Hr Employment Solutions Blogs Workforce Wise Blog

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Lawage Reporting Fill Out Sign Online Dochub

Garrison Shops Had A Suta Tax Rate Of 3 7 The State S Taxable Limit Was 8 000 Of Each Employee S Brainly Com

What Are Employer Taxes And Employee Taxes Gusto

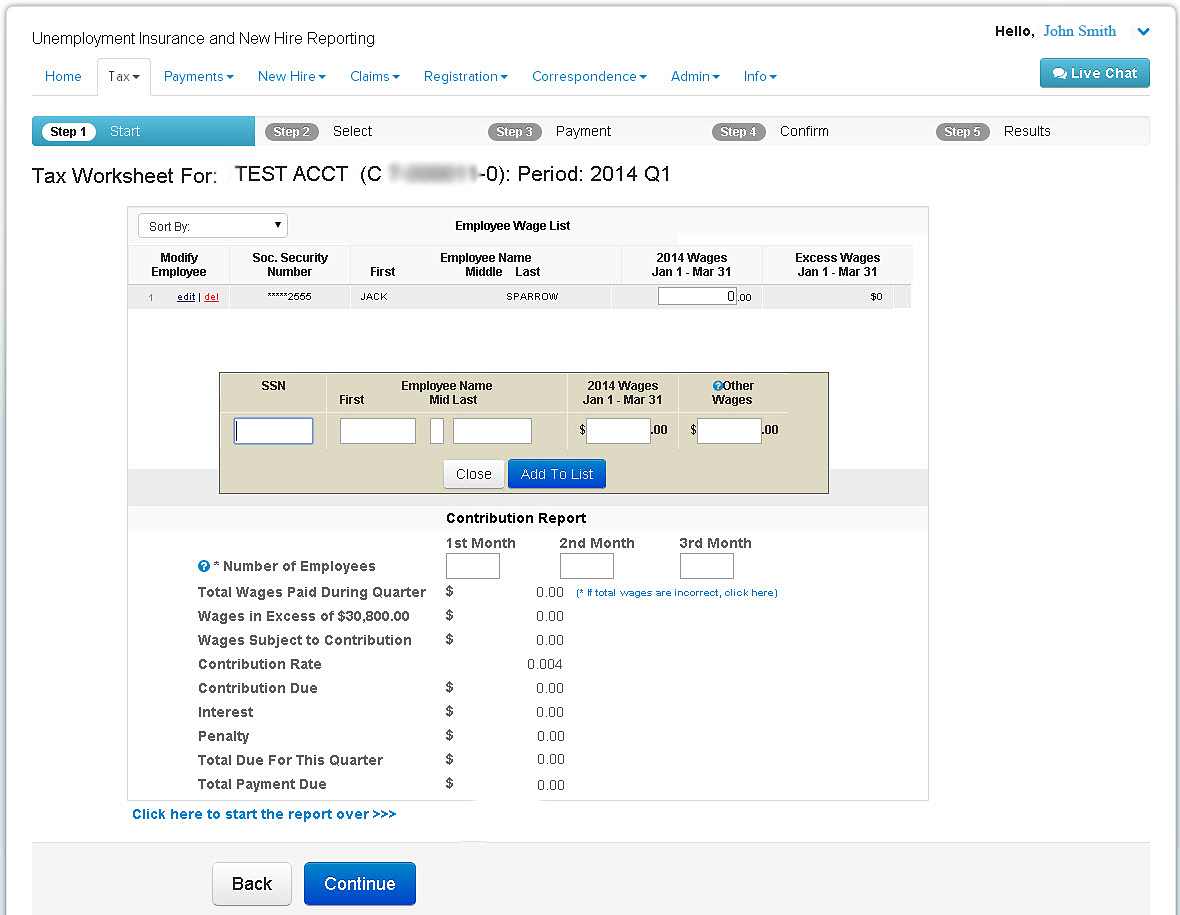

Utah Unemployment Insurance And New Hire Reporting

2022 Federal State Payroll Tax Rates For Employers

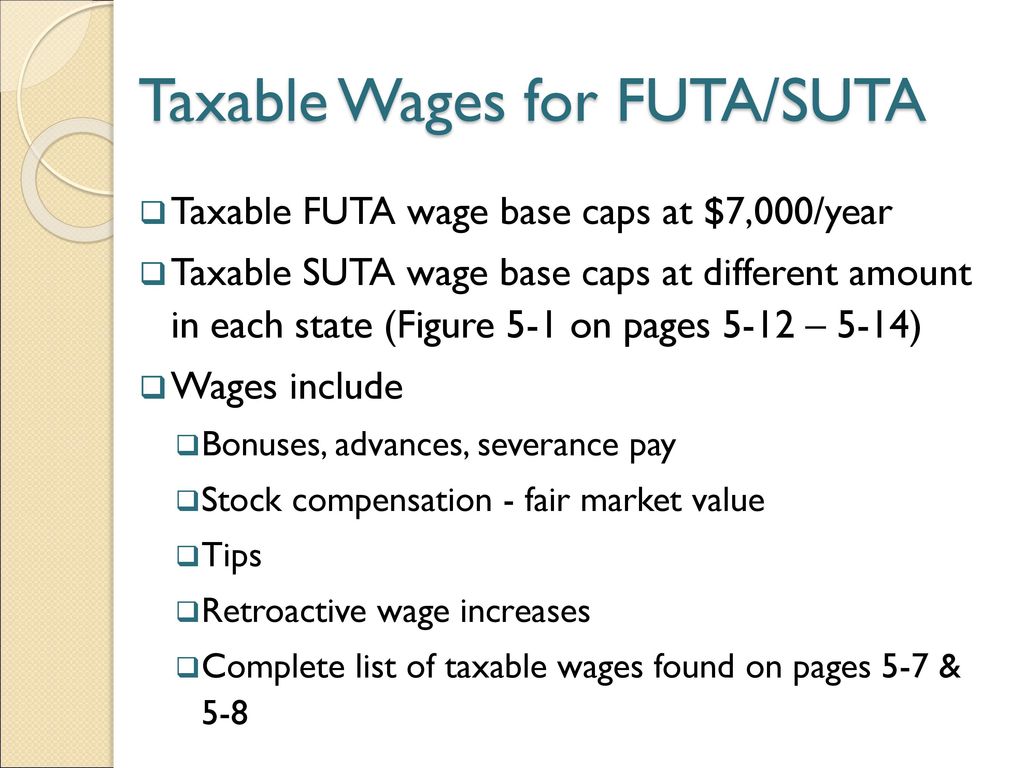

Chapter 5 Payroll Accounting 2011 Unemployment Compensation Taxes Ppt Download

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Exercise 11 5 Docx Exercise 11 5 Computing Suta Tax Lo 11 6 11 5 On April 30 2019 Chung Furniture Company Prepared Its State Unemployment Tax Course Hero